Planned Giving

Real Estate—Outright Gift

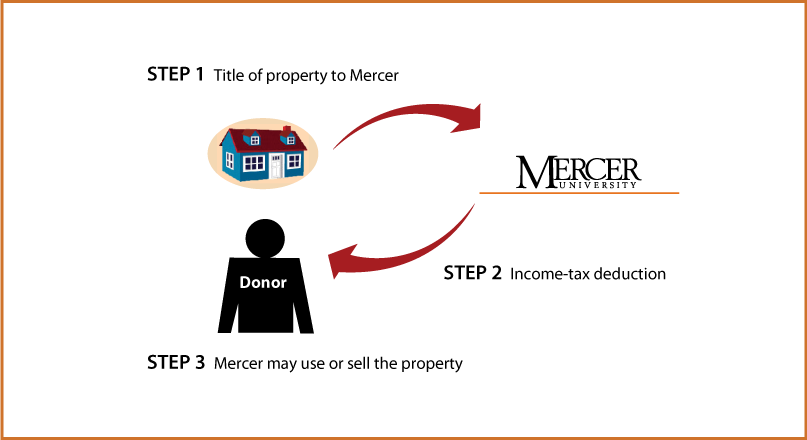

How It Works

- Transfer title of property to Mercer

- Receive income-tax deduction for fair-market value of property

- Mercer may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Mercer

More Information

Request an eBrochure

Request Calculation

Contact Us

Claude D. Smith, Jr. Federal Tax ID Number: 58-0566167 |

Mercer University |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer